Delivers All-time Group Quarterly Record Results for Net Sales, Adjusted EBIT, Adjusted EBIT Margin, Adjusted NOPAT and Operating Cash Flow

Adjusted NOPAT +22% to US$120.5 Million for the Second Quarter Fiscal Year 2021

Operating Cash Flow Rises +66% to US$416.8 Million for the First Half Fiscal Year 2021

Annual Ordinary Dividend Reinstated for Fiscal Year 2021

Reaffirms Fiscal Year 2021 Adjusted NOPAT Guidance Range of US$380 Million to US$420 Million

Fiscal Year Second Quarter 2021 Highlights, Compared to Fiscal Year Second Quarter 2020 as Applicable:

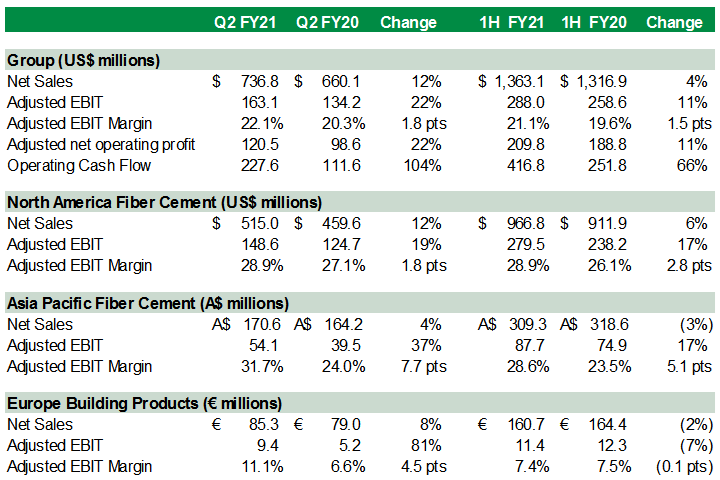

- Group Net Sales of US$736.8 million, +12% growth

- Group Adjusted EBIT of US$163.1 million, +22% growth

- Group Adjusted EBIT margin of 22.1%, an improvement of 180 bps

- North America Fiber Cement Segment Net Sales +12% and Adjusted EBIT +19% in US Dollars, with Adjusted EBIT margin up 180 basis points to 28.9%

- North America Fiber Cement Segment exteriors volume +11%

- Europe Building Products Segment Net Sales +8% and Adjusted EBIT +81% in Euros, with Adjusted EBIT margin up 450 basis points to 11.1%

- Asia Pacific Fiber Cement Segment Net Sales +4% and Adjusted EBIT +37% in Australian Dollars, with Adjusted EBIT margin up 770 basis points to 31.7%

- Reduce gross debt by US$400 million by the end of fiscal year 2021

- Reinstate an annual ordinary dividend for fiscal year 2021 supported by strong cash generation

James Hardie Industries plc (ASX: JHX; NYSE: JHX), the world’s #1 producer and marketer of high-performance fiber cement and fiber gypsum building solutions announced its second quarter and first half fiscal year 2021 results, for the periods ending 30 September 2020.

Record quarterly group net sales of US$736.8 million increased 12% year-over-year. Group Adjusted EBIT margin improved 180 basis points to 22.1%, with all three operating regions (North America, Asia Pacific, and Europe) delivering stronger financial results.

James Hardie CEO, Dr. Jack Truong, said, “Delivering these record results is a confirmation that the global strategy we launched in early calendar 2019 to transform James Hardie into a high-performing, world-class organization is on track and is accelerating. This is now the sixth consecutive quarter that our team has delivered growth above market with strong returns.”

Strong cash flow generation of US$416.8 million in the first half was driven by continuous improvement in the Company’s LEAN manufacturing performance, strong profitable sales growth and the integration of its supply chain with its customers. The Company has achieved global LEAN savings of US$62.0 million over the 18-month period since inception of LEAN. Working capital improved by US$101.5 million during the first half of fiscal year 2021.

Dr. Truong continued, “Our confidence in the global business and its resiliency to various market conditions continues to evolve. We expect to continue to invest strategically to unlock future organic growth, including the development and commercialization of consumer-focused innovations. These increased investments will include capacity expansion to meet growing demand for our products supported by aggressive marketing and brand building efforts as we seek to gain incremental share in all key markets in the coming years.”

The Company announced plans to reduce gross debt by US$400 million by the end of fiscal year 2021 and to reinstate an annual ordinary dividend for fiscal year 2021 with more details to be announced in May 2021.

“We continue to successfully navigate through this complex global pandemic, executing effectively on our strategic actions that were implemented at the start of the crisis. Our relentless commitment to servicing our customers resulted in record operating cash flow in the first half of fiscal year 2021. I am pleased to announce today that the step changes that we have made to improve our financial results and cash performance put us in a position to further strengthen our balance sheet and resume returning capital to our shareholders,” concluded Dr. Truong.

Outlook and Earnings Guidance

James Hardie continues to assess the impacts and the uncertainties of the COVID-19 pandemic on the geographic locations in which we operate, as well as its impact on the new construction and repair and remodel building markets. The COVID-19 pandemic remains highly volatile and continues to evolve, and the full impact of the pandemic on the Company’s business and future financial performance remains uncertain.

The Company is reaffirming its recently provided outlook for fiscal year 2021, ending March 31, 2021. Management expects fiscal year 2021 Adjusted net operating profit to be between US$380 million and US$420 million. The comparable Adjusted net operating profit for fiscal year 2020 was US$352.8 million. James Hardie’s guidance is based on current estimates and assumptions and is subject to several known and unknown uncertainties and risks, including those related to the COVID-19 pandemic.

Key Financial Information

Further Information

Readers are referred to the Company’s Condensed Consolidated Financial Statements and Management’s Analysis of Results for the six months ended 30 September 2020 for additional information regarding the Company’s results, including information regarding income taxes, the asbestos liability and contingent liabilities.

Management Briefing for Analysts, Investors and Media

James Hardie will conduct a teleconference and audio webcast for analysts, investors and media at 9:00am (AEDT) / 5:00pm (EDT) today. Analysts, investors and media can access the management briefing via the following:

- Live Webcast: https://ir.jameshardie.com.au/jh/results_briefings.jsp

- Live Teleconference Registration: https://s1.c-conf.com/diamondpass/10010586-ueislz.html

All participants wishing to join the teleconference will need to pre-register by navigating to https://s1.c-conf.com/diamondpass/10010586-ueislz.html Once registered, you will receive a calendar invite with dial-in numbers and a unique PIN which will be required to join the call.

Webcast Replay: Will be available two hours after the Live Webcast concludes at https://ir.jameshardie.com.au/jh/results_briefings.jsp

Use of Non-GAAP Financial Information; Australian Equivalent Terminology

This Media Release includes financial measures that are not considered a measure of financial performance under generally accepted accounting principles in the United States (GAAP), such as Adjusted net operating profit and Adjusted EBIT. These non-GAAP financial measures should not be considered to be more meaningful than the equivalent GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of its ongoing operations and excludes the impact of certain legacy items, such as asbestos adjustments. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with US GAAP, may not be reported by all of the Company’s competitors and may not be directly comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method of calculation. The Company is unable to forecast the comparable US GAAP financial measure for future periods due to, amongst other factors, uncertainty regarding the impact of actuarial estimates on asbestos-related assets and liabilities in future periods. For additional information regarding the non-GAAP financial measures presented in this Media Release, including a reconciliation of each non-GAAP financial measure to the equivalent US GAAP measure, see the section titled “Non-US GAAP Financial Measures” included in the Company’s Management’s Analysis of Results for the second quarter ended 30 September 2020.

In addition, this Media Release includes financial measures and descriptions that are considered to not be in accordance with US GAAP, but which are consistent with financial measures reported by Australian companies, such as operating profit, EBIT and EBIT margin. Since the Company prepares its Consolidated Financial Statements in accordance with US GAAP, the Company provides investors with a table and definitions presenting cross-references between each US GAAP financial measure used in the Company’s Consolidated Financial Statements to the equivalent non-US GAAP financial measure used in this Media Release. See the sections titled “Non-US GAAP Financial Measures” included in the Company’s Management’s Analysis of Results for the second quarter ended 30 September 2020.

Forward-Looking Statements

This Media Release contains forward-looking statements and information that are necessarily subject to risks, uncertainties and assumptions. Many factors could cause the actual results, performance or achievements of James Hardie to be materially different from those expressed or implied in this release, including, among others, the risks and uncertainties set forth in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2020; changes in general economic, political, governmental and business conditions globally and in the countries in which James Hardie does business; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business strategy and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. James Hardie assumes no obligation to update or correct the information contained in this Media Release except as required by law.

This media release has been authorized by the James Hardie Board of Directors.

END

Investor/Media/Analyst Enquiries:

Anna Collins

Telephone: +61 2 8845 3356

Email: media@jameshardie.com.au

James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20, Ireland