Survey Reveals Driving Factors

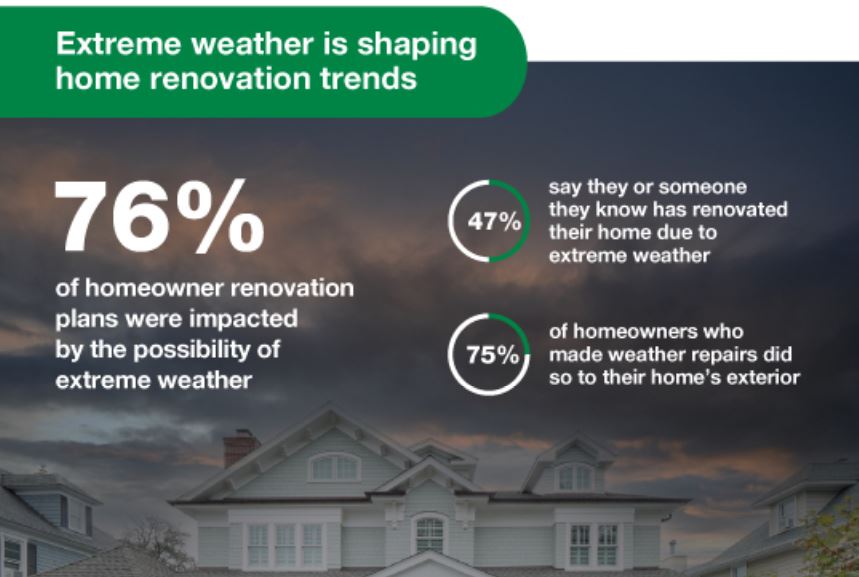

James Hardie Industries released findings from a nationwide survey, conducted by Wakfield Research, of 1,000 U.S. homeowners revealing the driving forces behind the home renovation boom during the COVID era. The survey results illustrate the impact of homeowners’ concerns about severe weather on their home renovation spending and choices. The survey also reveals a strong demand for renovating the exterior of the home, and clear demographic trend lines amongst U.S. homeowners–with parents and millennials driving the renovation demand, outspending all other demographics.

“The impact of climate change and severe weather on home design and spending is something we have been closely watching for several years now. Homeowners are looking to protect their homes and their families inside those homes. At James Hardie we believe our products provide that trusted protection,” says Fran Flanagan, Head of Consumer Insights at James Hardie. “Fiber cement siding is noncombustible and offers superior home protection against extreme weather, such as flooding, wind and fire. We have seen a marked increase in our consumers choosing Hardie® siding with the goal of better protecting their home from the elements.”

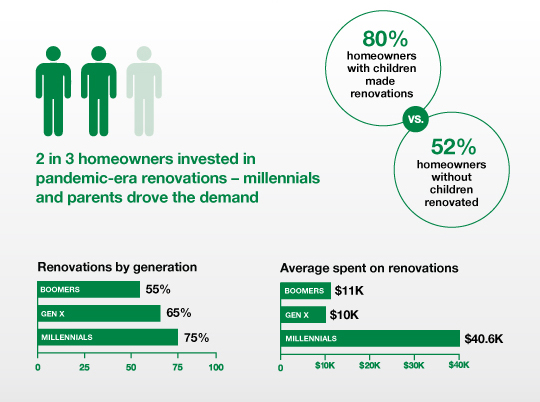

Who is fueling the demand?

The survey found that parents and millennials were disproportionately renovating; and the demand is not expected to abate this year. Millennials were the most likely (75%) to have made COVID-era renovations, and they spent more – $40,600 versus $10,000 for Gen X and $11,000 for boomers. In a tight housing market, this new generation of homeowners sees their first-home purchase as a long-term investment and forever homes. And perhaps due to remote learning needs, 4 in 5 parents (80%) made renovations versus only 52% of homeowners without children.

The Female Homeowner & Endless Design Possibilities

When it comes to renovations, married homeowners like to be in the driver’s seat. Among homeowners with a partner or spouse, 59% said they’re more likely to handle conversations on with contractors. But while women often disproportionately shoulder the burden of home maintenance, they’re not as likely to be involved in these conversations. Just 36% of partnered women said they would handle conversations with contractors, significantly fewer than the 82% of partnered men who said they’d handle it. But maybe men shouldn’t be so confident: among those who made COVID-era renovations, men were significantly more likely (29%) to regret at least one renovation (compared to 20% of women). In fact, men were more than twice as likely (21%) to regret multiple changes (compared to just 10% of women).

Demand for Fresh Exteriors in Renovation Market

The pandemic has meant spending more time at home for many people, leading homeowners to reassess their home’s exterior. A startling 70% of homeowners said their home exterior needs a facelift, with 59% of homeowners wanting to improve their home’s exterior (notably including 77% of parents).

According to the Leading Indicator of Remodeling Activity (LIRA), annual gains in homeowner improvement and maintenance spending were set to accelerate in the second half of 2021 and remain elevated through mid-year 2022. James Hardie’s study confirms this trend: 87% of homeowners said they want to continue renovating in 2022.

While the majority of COVID-era renovations were done to home interiors, homeowners still recognize the importance of investing in curb appeal. This consumer demand for fresh, modern exteriors that enhance curb appeal drives James Hardie’s continued investment in innovation to transform the way the world builds. Most recently, James Hardie debuted Hardie® Textured Panels, marking the creation of a whole new category in home exteriors.

Source: The James Hardie Survey was conducted by Wakefield Research among 1,000 nationally representative U.S. homeowners of single family or multi-family homes between October 4 and October 12, 2021.